Credit Card Review – HDFC Bank Diners ClubMiles

Introduction

The HDFC Bank Diners ClubMiles is an often ignored credit card overshadowed by its big brother (HDFC Diners Black) which offers some impressive benefits for travellers. ClubMiles is one of the best credit cards for beginner travellers and when combined with the 10x reward program can create some incredible travel redemptions.

Eligibility/Fees

- Net monthly Income of INR 30,000 per month

- Age – 21 Years to 60/65 for Salaried / Self-Employed

- Annual Fee – INR 1,000 + Taxes (Renewal fee is also same)

- Renewal Fee waived on spends of INR 100,000 in the last 12 months

- Welcome benefit of 1,000 points on payment of Annual / Renewal Fees

Reward Structure

The card earns 4 reward points per INR 150 spent. Each point is worth INR 0.5 and can be used to book flights and hotels at the Diners Smartbuy Portal. This is effectively a reward rate of INR 2 per 150 which is a fairly poor at 1.33%.

Airline Miles Exchange

The card offers much better value when exchanging them for airline miles. The card partners with 4 Airlines viz. Singapore Airlines / British Airways / Vistara Airlines / Jet Airways (Now defunct) and transfers miles in the ratio of 1:1 (1 Reward Point = 1 Airline Mile). This is much better value at 4 Airline Miles per INR 150 which is still an average rate of 2.66% assuming we value Airline Miles at 2.66%

10x Rewards

HDFC Bank has just recently extended its impressive 10x partner program till 31 Dec 2019 which offers an incredible 10x reward points on spends with partners. Spending on 10x partners will earn you 40 reward points per INR 150 which is an impressive 13% reward rate (On Diners Smartbuy Portal which is equal to cash) or 26% reward rate (If you convert to Airline Miles). For a beginner level card this is exceptional value.

The ClubMiles card has a limit on earning INR 10,000 bonus points per calendar month. These are split equally between Smartbuy (INR 5,000) and 10x Partners (INR 5,000). While this may look daunting, lets look at some simple ways in which we can maximise our earnings using this card and stacking it with 10x rewards.

Maximising 10x rewards

INR 5,000 on Smartbuy – This is fairly easy to achieve. Any Flights / Hotels booked on the Smartbuy Portal will earn you 26% in reward points. You essentially need to spend INR 18,750 and you will earn 18,750 x 40 / 100 = 5,000 reward points. You don’t need to book flights / hotels for yourself but you can book for friends and family as well.

INR 5,000 on 10x Partner – The current 10x partners of Diners are Myntra / Swiggy / Bookmyshow / PayZapp / Zoomcar / Natures Basket. You simply need to spend INR 18,750 to achieve the INR 5,000 target. PayZapp is the wildcard here and you can make payments for Utility / Mobile / DTH etc. for yourself and family. In addition, some people have had success with rent payments as well (Isn’t it unbelievable to get 26% on rent of around 19k. You should seriously check out Diners Black if you want to save 33% on your rent if you are eligible. Will detail this in a separate post soon once I actually receive my points).

You need to work hard on building up your points for only 3 months to reach a level where you can redeem rewards for some serious mouthwatering travels.

Redemption Sweet Spots

Let’s assume that you are able to build a kitty of 30,000 points (worth INR 15,000 on the SmartBuy Portal) . These would have required spends of approximately INR 112,500.

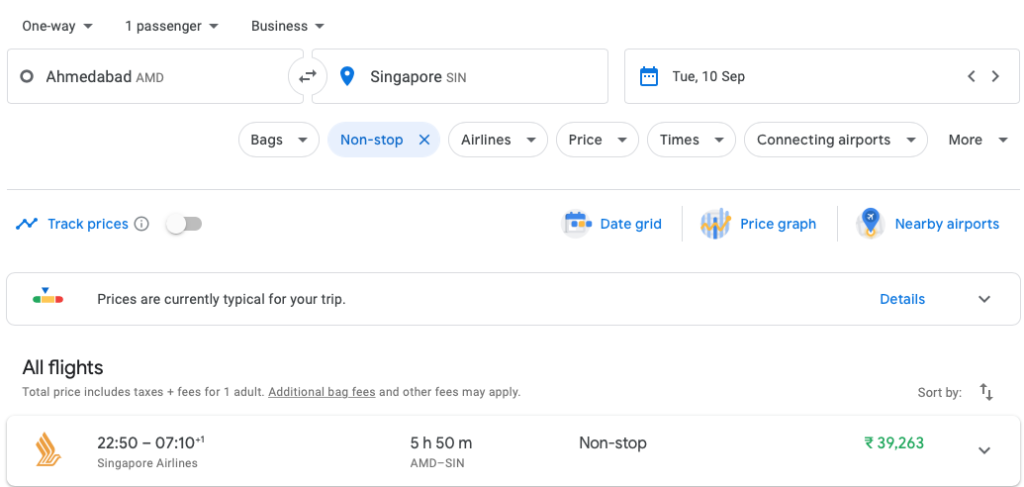

Redemption #1 – Singapore Airlines Business Class – Singapore Airlines offers one of the best business class products in the world. I found their Hard product to be even more spacious as compared to QSuites. The photo below is of their 777 product as the A380 was under maintenance. A380 business should be a notch above.

Singapore Airlines regularly runs Spontaneous Escapes which offers discounts on miles required for travel in Business Class as well as Economy. A one way award in Business Class from various cities in India (Ahmedabad / Bangalore / Kolkata / Mumbai / Delhi ) to Singapore costs anywhere between 18,500 to 27,300 miles. At present it costs 27,300 miles till 30 September 2019. Singapore also has very low surcharges on award tickets. Please check this link for the most accurate current offers.

The above presents an incredible value for money as one way tickets from the above list of cities to Singapore will be fairly expensive. For example a one way Business Class ticket from Ahmedabad to Singapore costs INR 40,000. From other cities also, the fare will not be lower than INR 35,000.

This is fantastic redemption and you can assume you earned 35,000 on spending 27,300 miles which cost approximately INR 102,375 of spends. This is an approximately 34% return on spends which is phenomenal for a mid tier card.

Redemption #2 – Intra Europe Flights on BA – For the more practical travellers who don’t mind traveling in Economy British Airways Avios are an incredible currency to hold. A one way economy ticket in Europe on BA will only cost 4,000 points in off season + approximately 1,500 INR in taxes (may vary depending on departing airport). This is lower than the cash fare and offers a 1:1 redemption of miles to cash which is an impressive 26% reward rate.

Redemption #3 – Intra India flights on Vistara – Vistara is expanding its network in India at a decent pace and Delhi is a hub for the Airline. After the Jet Airways Fiasco, it is the only decent full service carrier in India (Sorry Air India) and offers decent award tickets although you may find it a bit difficult to get a 1:1 redemption compared to cash fares. Do note that their premium economy offerings are worth a look as the points difference is not steep. This is still a great option for those who don’t travel to international destinations regularly. Its always prudent to earn and burn rather than accumulate and see devaluations hit you (I’m still stuck with JP Miles in 5 figures with absolutely no great redemption options). Check out this link for their full redemption chart. (Please do note that the below chart is valid only till 31 Aug 19 and then changes to a slightly steeper one for some destinations)

Other Benefits

The card offers 6 complimentary lounges worldwide in a calendar year. Diners has a decent lounge network (not as great as priority pass but still ok) and this can save you a lot of money when traveling in economy. A full list of lounges is available here.

The card offers emergency medical insurance of INR 25 lacs for travel outside India for a period less than 30 days. I have used this in the past and it does require a bit of follow up but got reimbursed in the end. This cannot be used while applying for the VISA.

There are some other benefits as well which you can check out on this link

Summary

At first glance, the club miles card looks like an average card. On deeper inspection, upon stacking this card with the right offers, this card seriously punches above its weight. It is a great beginner travel credit card and you would not be disappointed.

You May Also Like

Citi Prestige Meet & Assist + Airport Transfer Service Review

September 2, 2019

Get 33% Cashback on Uber Premier rides using HDFC Bank Credit Cards

October 2, 2019