Earn upto 7% on your house rent in India

Paying House Rent is one of the top expenses for most people working in metro cities in India. Until recently, you had to rely on cash/cheque/bank transfers to make your rent payments. Some new vendors have opened up in this space allowing you to pay your house rent using credit cards and earn upto 7% back in terms of rewards.

The Benefits

Before we go into more details, let us look at some of the benefits of paying your rent via credit card

- Stating the obvious but credit cards allow you to earn reward points on your spends which is an alternate form of cash back itself

- You earn a credit period of anywhere between 45-60 days which can be considered as incremental income itself (Say a 6% cost of funding for 45 days transforms into an effective cash back of 0.75%)

- There is a proper record of all your transactions in one place compared to making payments via cash/cheque/bank transfers which can be tedious to organise

Current Players

There are currently 3 players that I am aware of which offer such services. Let us look at each one of them below.

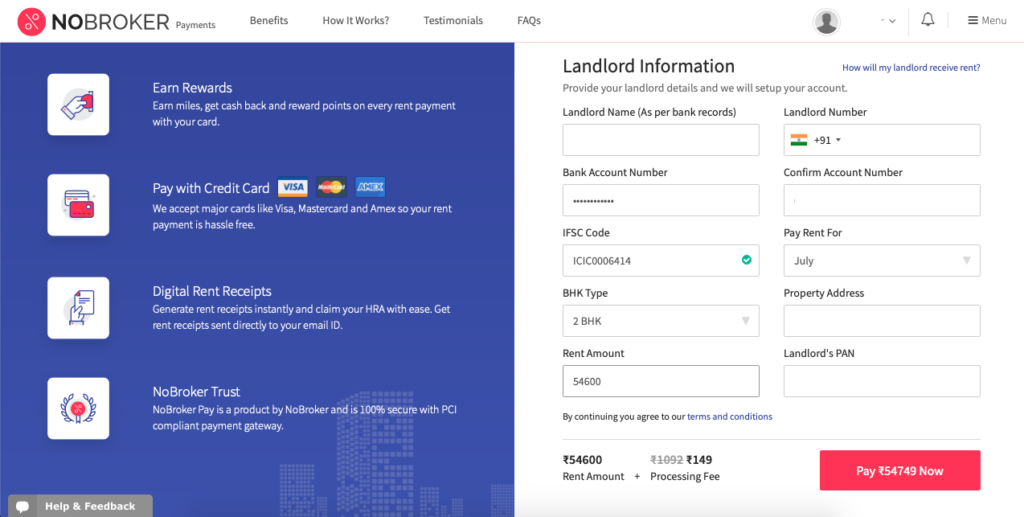

Option #1 – www.nobroker.in

This was a site designed to help buyers and sellers of property and rental space without brokers which has recently branched out into the rent payments space.

Processing Fees – Flat 149 Rs irrespective of amount which is great till it lasts

Supported Cards/Banks – All Master / Visa / Amex cards and hence support is almost universal

Onboarding Time – Almost NIL as you do not have to upload a rent agreement

Option #2 – redgiraffe.com

(The link does not seem to work properly, please type manually in browser to visit their site)

This is a global player and was probably the first to enter this space in India

Processing Fees – 0.39% + GST or 39 Rs per INR 10,000 + GST (If your rent is higher than INR 32,000 then nobroker will be cheaper)

Supported Cards/Banks – They only have tie ups with SBI / IndusInd / ICICI / HDFC / Kotak & Yes

Onboarding Time – Took around 4-5 days for my agreement to be accepted

Option #3 – www.paymatrix.in

They seem to be the latest entrant in this space

Processing Fees – 1.50% + GST

Supported Cards/Banks – They seem to accept Visa / Master / Amex / Diners which is comprehensive but they also have a list of banks on their site. I am not 100% sure about this and will post an update once I find out more on this.

Onboarding Time – Not yet tried but should take at least 1-2 days as it requires rent agreement to be uploaded and accepted

My Choice

I am currently using www.nobroker.in due to the following benefits

- No need to upload the rent agreement – Privacy is still a big concern and if you are not comfortable with sharing your data this is a big plus point

- No wait time – While this may be true only for the first time, since there is no requirement of validation of rent agreements, it is very easy to set up and make payments

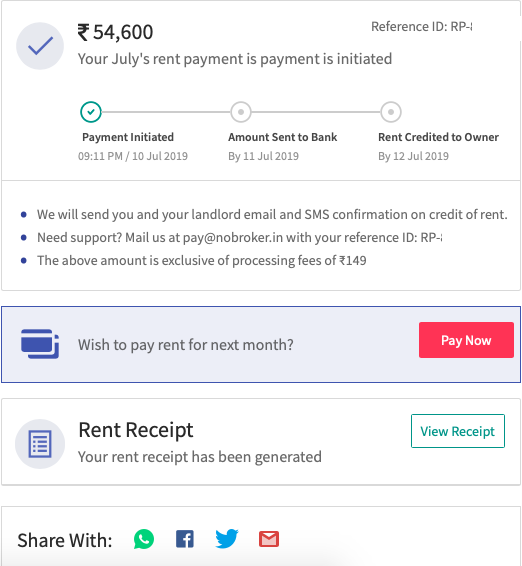

- Rent Receipt in your email

- Single Screen / Easy to use – Screenshot below

- You can schedule payments for next months rent also

- The system stores landlord details so that you do not have to type them every time (Assuming all others also do the same)

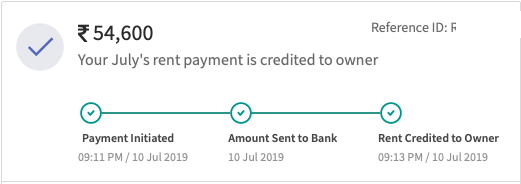

- You get a confirmation when rent is credited to landlord account

- You can share transaction details directly with landlord right from payment page (Screenshot below)

- Fast Processing – While they claim that rent is paid to the landlord within 2 working days, in my case it was in 2 minutes and many colleagues who use this also had rent credited on the same day.

Earning upto 7% in rewards

The credit card strategy I tend to use and would advise to others is outlined below

For the first INR 400,000 (4 lacs) of rent

Use the American Express Platinum Travel Credit Card as this is a category spend agnostic card which will earn you approximately INR 30,000 in rewards on spending INR 400,000. Read the complete details here. This card has a first year fee of INR 3,500 + taxes and a second year onwards fee of INR 5,000 + taxes. If you apply using this link you will get the first year fee waived off and also earn 2,000 bonus membership reward points (worth at least INR 1,000). Even if you account for the INR 5,000 + taxes from second year onwards the cash back is still impressive at around 6%

For amounts beyond INR 400,000 of rent

After exhausting the lucrative 6-7% reward rate on amex platinum I would advise you to move your spends to the Citi Prestige Credit Card which has a reward rate of 4% on all spends (Assuming valuation of 1 Airline Mile = 1 INR). This card has a high sign up fee as it is Citibank’s top end credit card in India.

Another alternative would be to move spends to the HDFC Bank Diners Club Black Credit Card which has a reward rate of 3.33% on all spends. These can be more easily redeemed in a 1:1 ratio against travel bookings (Hotels or Flights). If you don’t have time or find managing the miles game a bit overwhelming, this would be a better option compared to the Citi Prestige.

The reward rate beyond INR 400,000 of annual rent will drop but even 4% overall is not a bad number. To put it in perspective, INR 30,000 savings is not a small amount for INR 4 lacs of annual rent.

NoBroker Tips

I have heard rumours of NoBroker contacting owners directly for leasing out their flats for rent (Nothing in life is free right). It might make sense to give your own alternate number in the landlord mobile number section to avoid axing your own foot (Even if the probability is low). That is probably why their price is so low currently and it may not last forever.

Summary

I was initially reluctant due to privacy concerns but have recently started making rent payments using nobroker. It is great to see more competition in this sector and it is definitely win-win for us. If you have not yet started making rent payments using credit cards, its time you at least start thinking about it. Reward points values can be further maximised by staying on top of offers which you can track by subscribing to twitter feeds of blogs like ours :). What do you think?

You May Also Like

HDFC Bank Diners Club – Major Updates announced

November 1, 2019

HDFC Bank SmartBuy Update – 33% Cashback on Train Tickets

December 12, 2019